How to master insurance push notifications

Push notifications are not new. Although they have been around since 2008, insurance companies are only just beginning to realise their potential. Imagine being able to send highly personalised messages directly to customers on their smartphone, tablet or PC anytime and anywhere.

Used wisely, they offer a tremendous opportunity to drive customer engagement though the roof.

What are Push Notifications & how are they used in insurance?

Push notifications are the instant popup messages that appear on your mobile, tablet or desktop usually with an update message from a website or app you subscribed to.

Push messages are usually written and sent out by marketing departments aiming to increase user engagement or sell a product. A typical push message contains a small image or logo, a short title and description. As a rule of thumb, shorter messages have higher open rates.

A message could be about any subject at all, though the best messages are highly personalized and relevant to the client. Some examples on insurance push notifications are:

- News of a special offer or promotion

- A reminder to complete an online signup they abandoned

- Upcoming event reminders

- A link to a new blog post they subscribed to

- Or just a reminder to the user that you are still there (useful if they have not opened your website or app for a long time)

Used strategically push notifications are an excellent way to remind users about your site or app and have been shown in studies to improve engagement and user retention. They should be used in the right dosage: too many or irrelevant notifications can irritate users, whilst not enough messages can fail to engage. In both cases, users could mute notifications or worse, delete your app.

Push notifications are very effective in insurance

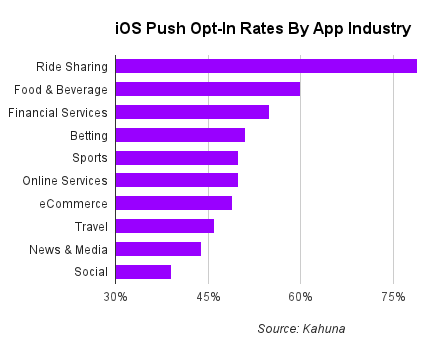

A study by marketing automation platform Kahuna, shows the financial services sector (55%) has among the highest Push opt-in rates.

Furthermore the same study showed that financial services also have the highest engagement rates across all major sectors.

For many Insurtech, the question is how to use push notifications the right way. How do you strike the balance between driving users to your website/app, and turning users off?

Below I have shared a few of my push strategy secrets to get clients opening your apps and interacting with your brand.

1. Encourage opt-in

Before thinking about your push notification content, you first need to get clients to opt-in.

Most apps use a standard prompt at the top of the screen (which many users instinctively close down or ignore), or a bell icon in the bottom right corner of the screen. Both offer convenient ways to sign up.

An effective way to increase opt-ins is to create a splash screen or banner that explains the benefits of push in a few carefully chosen words. Carefully point out the benefits that subscribing will bring the user. Although they can’t sign-up through the splash screen, you have planted the idea in their head so they are more likely to sign-up later.

2. The more personal the message, the better the open rate

A data science report by Leanplum found push notifications containing personalized content see four times the open rate of generic messages. So how can you do that when you don’t even know the user’s name?

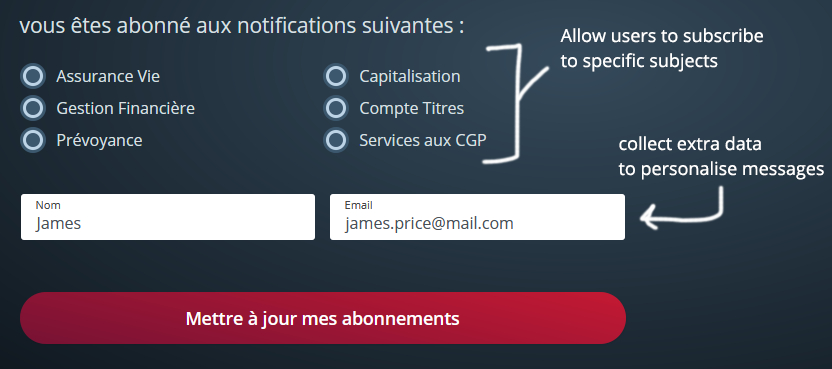

When we integrated push into a french financial planner website, we created a notifications page allowing users to subscribe to specific topics (this is the best way to increase message relevance). At the same time we offered an optional name and email field which most users filled in. This allowed us to personalise their push notifications.

3. Segment your user base as much as possible

Segmenting your subscribers allows you to send more relevant messages. For example, suppose you are sending a push about an upcoming broker conference. As you really don’t want to send that to customers, as a minimum you need two separate segments, customer and broker, for users to opt-in to. This allows you to segment users into separate pots and message them separately.

Taking it a step further, now suppose you want to cross-sell a new dental insurance product to your health insurance clients. Segmenting would allow you to specifically target your health insurance base with a customized message and special offer.

Conclusion

Push notifications almost seem made for the industry industry. The key to any successful push strategy is dividing your base in to smaller groups and hitting them with highly relevant messages, and with the right frequency – not too many but not too few. This will ensure quality communication and high engagement.

Get push notifications set up on your site or app today – contact us here.